Publications

Working Papers

Curriculum Vitae (pdf)

| Contact details |

Bank of Italy

Research Department

Via Nazionale 91

00184 Rome

Italy

Email me

| Favourite Links |

Bank of Italy

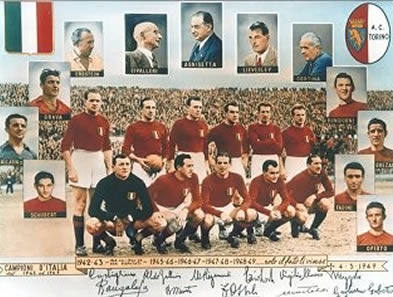

Torino Football Club

Research articles

26. Busetti, F., Neri, S., Notarpietro, A. and M. Pisani (2021), Monetary policy strategies in the New Normal: A model-based analysis for the euro area, Journal of Macroeconomics. (WP)

25. Busetti, F., Caivano, M., Delle Monache, D. and C. Pacella (2021), The time-varying risk of Italian GDP, Economic Modelling. (WP)

24. Busetti, F., Caivano, M. and D. Delle Monache (2021), Domestic and global determinants of inflation: evidence from expectile regression, Oxford Bulletin of Economics and Statistics. (WP)

23. Busetti, F. and M. Caivano (2019), Low frequency drivers of the real interest rate: empirical evidence for advanced economies, International Finance. (WP)

22. Busetti, F. (2017), Quantile aggregation of density forecasts, Oxford Bulletin of Economics and Statistics. (WP)

21. Busetti, F. and M. Caivano (2016), The trend-cycle decomposition of output and the Phillips curve: Bayesian estimates for Italy and the euro area, Empirical Economics. (WP)

20. Busetti, F., Giordano, C. and G. Zevi (2016), The drivers of Italy's investment slump during the double recession, Italian Economic Journal. (WP)

19. Busetti, F. (2015), On detecting end-of-sample instabilities, in Koopman S.J. and N. Shephard eds, Unobserved Components and Time Series Econometrics, Oxford University Press. (WP)

18. Busetti, F. and J. Marcucci (2013), Comparing forecast accuracy: a Monte Carlo investigation, International Journal of Forecasting 29, 13-27. (WP)

17. Busetti, F. and A.C. Harvey (2011), When is a copula constant? A test for changing relationships, Journal of Financial Econometrics 9, 106-131. (WP)

16. Busetti, F. and S. di Sanzo (2011), Bootstrap LR tests of stationarity, common trends and cointegration, Journal of Statistical Computation and Simulation. (WP)

15. Busetti, F. and A.C. Harvey (2010), Tests of strict stationarity based on quantile indicators, Journal of Time Series Analysis 31, 435-450.(WP)

14. Busetti, F. (2009), Initial conditions and stationarity tests, Economics Letters. (pdf)

13. Busetti, F. and A.C. Harvey (2008), Testing for trend, Econometric Theory, 72-87. (WP)

12. Busetti, F., Forni, L., Harvey, A.C. and F. Venditti (2007), Inflation convergence and divergence within the European Monetary Union, International Journal of Central Banking, 95-121. (WP)

11. Busetti, F. (2006), Tests of seasonal integration and cointegration in multivariate unobserved component models, Journal of Applied Econometrics 21, 419-438. (WP)

10. Busetti, F., Fabiani, S. and A.C. Harvey (2006), Convergence of prices and rates of inflation, Oxford Bulletin of Economics and Statistics 68, 863-877. (WP)

9. Busetti, F. (2006), Preliminary data and econometric forecasting: an application with the Bank of Italy quarterly model, Journal of Forecasting 25, 1-23. (WP)

8. Busetti, F. and A.M.R. Taylor (2005), Stationarity tests for irregularly spaced observations and the effects of sampling frequency on power, Econometric Theory 21 (2005), 757-794. (WP)

7. Busetti, F. and A.M.R. Taylor (2004), Tests of stationarity against a change in persistence, Journal of Econometrics 123 , 33-66. (pdf)

6. Busetti, F. and A.C. Harvey (2003), Seasonality tests, Journal of Business and Economic Statistics 21, 420-436. (pdf)

5. Busetti, F. and A.C. Harvey (2003), Further Comments on Stationarity Tests in Series with Structural Breaks at Unknown Points, Journal of Time Series Analysis, 137-140.

4. Busetti, F. and A.M.R. Taylor (2003), Variance shifts, structural breaks and stationarity tests, Journal of Business and Economic Statistics 21, 510-531.

3. Busetti, F. and A.M.R. Taylor (2003), Testing against stochastic trend and seasonality in the presence of unattended breaks and unit roots, Journal of Econometrics 117, 21-53. (WP)

2. Busetti, F. (2002), Testing for (common) stochastic trends in the presence of structural breaks, Journal of Forecasting, 81-105. (WP)

1. Busetti, F. and A.C. Harvey (2001), Testing for the presence of a random walk in series with structural breaks, Journal of Time Series Analysis, 127-150. (WP)

Policy papers

Neri, S., Busetti, C. Conflitti, F. Corsello, D. Delle Monache and A. Tagliabracci, Energy price shocks and inflation in the euro area, SUERF Policy Brief, n. 710, 2023.

Busetti, F., Neri, S., Notarpietro, A. and M. Pisani, Monetary policy strategies in the New Normal, SUERF Policy Brief, n. 215, 2021.

Busetti, F., Giorgiantonio, C., Ivaldi, G., Mocetti, S., Notarpietro, A. and P. Tommasino, Capital and public investment in Italy: macroeconomic effects, measurement and regulatory weaknesses, Bank of Italy Occasional papers n. 520, 2019.

Bulligan, G., Busetti, F., Caivano, M., Cova, P., Fantino, D., Locarno, A. and L. Rodano, The Bank of Italy econometric model: an update of the main equations and model elasticities, Bank of Italy Discussion papers n. 1130, 2017.

Busetti, F., Giordano C. and G. Zevi, Main drivers of the recent decline in Italy's non construction investment, Bank of Italy Occasional papers n. 276, 2015.

Busetti, F., Ferrero, G., Gerali A. and A. Locarno, Deflationary shocks and de-anchoring of inflation expectations, Bank of Italy Occasional papers n. 252, 2014.

Busetti, F. and P. Cova, The macroeconomic impact of the sovereign debt crisis: a counterfactual analysis for the Italian economy, Bank of Italy Occasional papers n. 201, 2013.

Busetti, F., Locarno, A. and L. Monteforte, The Bank of Italy’s quarterly model, in G. Fagan and J. Morgan eds, Econometric Models of the Euro-area Central Banks, Edwar Elgar, Cheltenham, UK, 2005.